Travel credit cards can be absolute game-changers, especially when you’re a frequent flyer. The perks—free checked bags, priority boarding, companion passes—can feel like travel hacks you’ll never want to give up. But what happens when your travel patterns shift and that once-perfect card no longer fits your lifestyle? This was exactly the situation I found myself in. Let’s talk about downgrading your credit card.

Back in 2022, I was convinced the American Express Delta Skymiles Platinum Card was going to be my go-to. After moving back to the East Coast, I figured Delta would be my primary airline. The perks were solid: a hefty welcome bonus, the allure of the annual companion pass, free checked luggage, priority boarding—the whole package. It seemed like a no-brainer. But reality had other plans.

Perks not Worth the Price

Fast forward, and I realized I had only flown Delta three times since opening the card. Three. The companion pass? Never used it. Sure, the free checked luggage was nice, but was it worth the $350 annual fee? Definitely not. That fee started to feel like a drain on my wallet rather than a travel perk.

The Delta Skymiles Platinum Card offers a host of benefits designed for loyal Delta flyers. Beyond the welcome bonus and companion pass, there’s the first checked bag free for you and up to eight companions on the same reservation, saving a decent chunk on baggage fees. Priority boarding helps ensure overhead bin space and a smooth boarding process. Plus, the card includes 20% savings on in-flight purchases and gives access to Status Boost®, helping you earn Medallion® Qualification Miles (MQMs) through your spending.

It also offers trip protections like baggage insurance and trip delay coverage, which can be a lifesaver during unexpected travel hiccups. You even get a Global Entry or TSA PreCheck fee credit, and no foreign transaction fees make it friendly for international travel.

But here’s the thing—I wasn’t using most of these perks. The companion pass? Never activated. Priority boarding? Didn’t matter when I wasn’t flying Delta often. Trip protections? Great in theory, but useless if I wasn’t booking Delta flights. The free checked bags were probably the only benefit I consistently used, but even that wasn’t enough to justify the hefty annual fee, especially when my travel plans mostly revolved around Caribbean Carnival events on islands Delta didn’t serve as frequently or affordably.

As a Caribbean Carnival chaser, my travel patterns didn’t exactly align with Delta’s routes. Carnival often takes me to islands where American Airlines, JetBlue, or other carriers have better flight options or prices. I needed flexibility to maximize points and miles for my Carnival trips, but this card was locking me into an airline I wasn’t frequently using.

As a Caribbean Carnival chaser, my travel patterns didn’t exactly align with Delta’s routes. Carnival often takes me to islands where American Airlines, JetBlue, or other carriers have better flight options or prices. I needed flexibility to maximize points and miles for my Carnival trips, but this card was locking me into an airline I wasn’t frequently using.

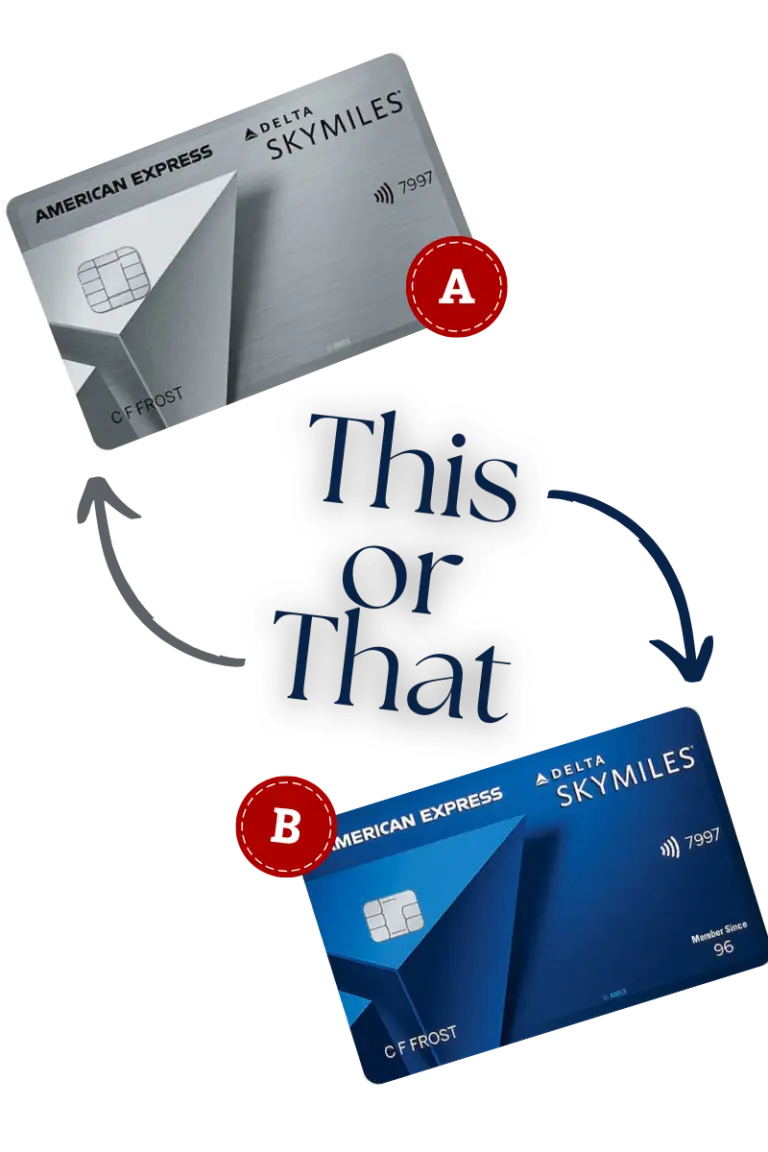

Deciding to Downgrade my Airline Credit Card

I hit a crossroads. Do I close the card entirely or is there another option? Closing this travel credit card would have been the easy answer—but not the smartest one. Credit cards aren’t just about perks; they’re also about how they impact your credit score. When you close a card, you reduce your overall available credit, which can raise your credit utilization rate. Higher utilization? That’s a red flag for your credit score.

Instead, I opted for a smarter move: I downgraded the card to the Delta Skymiles Blue Card. No annual fee, fewer bells and whistles, but still a way to keep my SkyMiles account active and maintain my credit line. It felt like hitting the reset button without losing the foundation I had built.

The Delta Skymiles Blue: Simple, Flexible, and Free

The Delta Skymiles Blue isn’t trying to be flashy—it’s straightforward, and sometimes that’s exactly what you need. One of its biggest selling points is that it carries no annual fee, meaning I could maintain my Delta Skymiles account without worrying about an extra yearly charge.

But it’s not just about being fee-free. The Delta Skymiles Blue still offers solid perks for occasional Delta flyers like me. It earns 2X miles on Delta purchases, making it easy to rack up points whenever I do decide to book a Delta flight. Plus, it gives 2X miles at restaurants worldwide, including takeout and delivery, which is a nice everyday bonus. All other purchases earn 1X miles, so I’m still building up my SkyMiles balance no matter where I spend.

Another handy perk? There’s a 20% in-flight savings on Delta purchases, like snacks, drinks, and even Wi-Fi. While I’m not flying Delta often, it’s nice to know that when I do, I’m still getting those little savings that add up over time.

And let’s not forget the no foreign transaction fees. For someone who loves international travel—especially hopping between Caribbean islands for Carnival—this is a must-have feature. I can swipe my card abroad without worrying about extra fees sneaking onto my bill.

While I don’t fly Delta often, the ability to still earn a multiplier on Delta bookings, enjoy in-flight savings, and keep my SkyMiles active makes this card a no-brainer for my wallet. I’m not paying for perks I’m not using, but I still get rewarded when I do fly with Delta. And since there’s no annual fee, I’m not losing money in the process. It just makes more sense.

Carnival Travel Perks: Making Your Credit Work for You

This approach has been a lifesaver for my Caribbean Carnival travels. By freeing up the annual fee, I could put more money toward flights that better fit my Carnival schedule, book last-minute hotel deals, or splurge on that extra fete ticket. Plus, by keeping my credit intact, I could still leverage other travel cards that offered points or miles for the airlines I actually use for Carnival trips.

But beyond credit scores and perks, there’s a bigger lesson here: it’s okay for your financial strategies to evolve as your lifestyle changes. Travel habits aren’t static. One year, you might be all-in on Delta. The next, you’re chasing the best points deals with another airline. Downgrading gives you flexibility. And if down the road I decide Delta is my go-to again? I can always upgrade.

Sometimes downgrading is not an option. To learn about reasons to close your credit card account, click here.

Flexibility is Key in Credit and Travel

So before you shut down that travel credit card that’s no longer serving you, consider a downgrade. It keeps your credit intact, saves you from unnecessary fees, and gives you space to pivot if your travel patterns shift again.

Because at the end of the day, credit cards should work for you—not against you.